Relevance

The relevance analysis inquires whether the report discloses information on topics identified as relevant for the company, industry and country. Issues have been selected from an inside-out and outside-in perspective, using the RepRisk ESG Risk Platform, the Materiality Map™ of the Sustainability Accounting Standards Board (SASB) and the GAPFRAME of Business School Lausanne. Read more about the methodology.

Industry Ranking

%

Average industry score

- Chemistry & pharmaceuticals (2017: 64%) 70%

- Food & beverage sector (2017: 35%) 65%

- Construction builders suppliers (2017: 70%) 60%

- Retail & wholesale trade (2017: 64%) 57%

- Insurance services (2017: 45%) 57%

- Gastronomy & hotels (2017: 61%) 52%

- Other service providers (2017: 74%) 51%

- Machine industry (2017: 53%) 51%

- IT, medical & electrical engineering (2017: 58%) 50%

- Mobility, transport & logistics (2017: 59%) 50%

- Financial services (2017: 66%) 49%

- Manufacturing industry (2017: 48%) 46%

- Manufacturing industry (2017: 48%) 46%

- Energy supply & distribution (2017: 40%) 45%

- Real estate (2017: 33%) 35%

Company level

Critical press articles about the company, on environmental, social and governance issues (ESG), identified via the RepRisk ESG Risk Platform

Industry level

Material sustainability issues on an industry-by-industry basis, identified via the SASB Materiality Map™ and the RepRisk ESG Risk Platform

Country level

Relevant country issues, identified via the GAPFRAME, which translates the Sustainable Development Goals into 24 issues relevant to all nations and businesses.

Company level

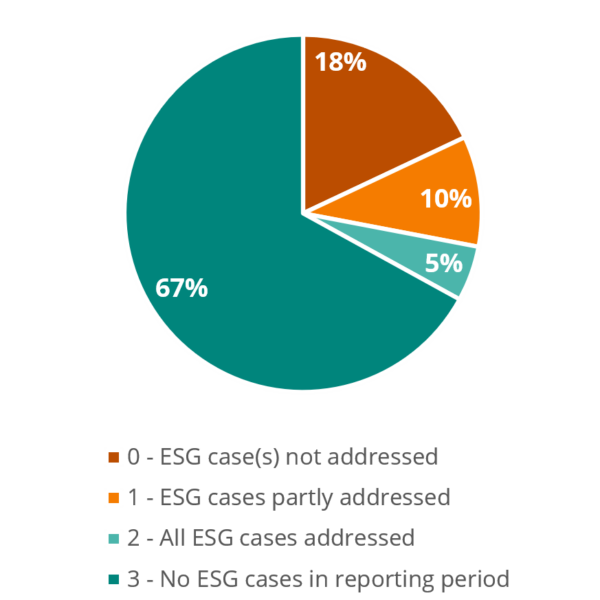

A sustainability report must mention critical or negative press articles on environmental, social and governance issues (ESG) to increase trust.

33% of the companies analysed had ESG cases published in press articles. These cases are classified as VERY RELEVANT (in 2017: 26%). The majority of companies (22 out of 40 companies) with critical press articles do not report on these cases.

Industry level

Companies should consider to assess the relevance of critical industry issues to the company.

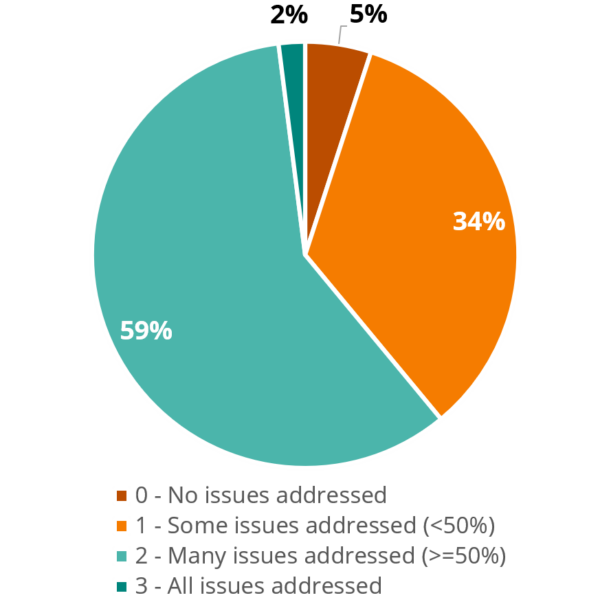

61% of analysed companies report on at least 50% of identified industry issues (in 2017: 75%), of which 2% cover all topics (in 2017: 6%). The remaining companies cover less than 50% of industry issues, including 5% that do not report on any sector-specific issue (in 2017: 1%). The results show that especially in this area companies perform worse in 2019 than in 2017.

Country level

According to the GAPFRAME, critical issues for Switzerland are: biodiversity, carbon quotient, clean energy, equal opportunity, oceans and sustainable consumption. Companies should consider to assess the relevance of these issues to the company.

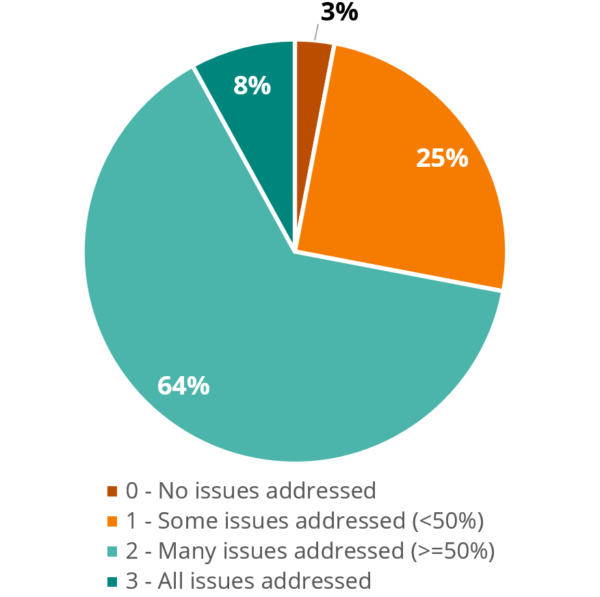

8% of the companies analysed cover all critical topics in Switzerland in their sustainability report (in 2017: 5%). Similar to 2017, about two out of three companies report on at least 50% of topics relevant to Switzerland. 28% report on less than 50% of the relevant Swiss topics (in 2017: 30%), of which 3% report on none of these topics (in 2017: 1%).